Best Payday Loans For 2023

Payday loans have long been a contentious topic. While they are seldom the ideal choice for financial stability, the reality is that they are sometimes the only option available. That's why we have created this article, to help you find the best payday loan for your situation. We will also answer commonly asked payday loan questions, and provide alternatives to payday loans.

It’s vital to be well informed on payday loans before you take one, as they mustn't be taken lightly.

If you need help getting a grip on your finances, visit Money Helper.

Contents

-

What are the best payday loans in the UK?

- Best overall payday loan

- Best low-interest payday loan

- Easiest payday loan to get approved for

- Best payday loan for bad credit

- Quickest payday loan

- Best payday loan for early repayment

-

How to choose the best payday loan for your situation

- Six things to consider when choosing your payday loan

- Dos and don’ts of applying for a payday loan

- Pros and cons of payday loans

- What are some alternatives to payday loans?

- Best payday loans FAQ

What are the best payday loans in the UK?

There are many factors that go into choosing a payday loan, so what is perfect for one may not be so for another. We’ve created a list of payday loans that are best for each unique situation.

Best overall payday loan

Bee Loans

- Two-minute application

- Same day cash

- Flexible repayments

£400 borrowed for 90 days. Total amount repayable is £561.92 in 3 monthly instalments of £187.31. Interest charged is £161.92, interest rate 161.9% (variable). Representative 305.9% APR.

Best low-interest payday loan

Conduit Loans

- Low interest rate

- Flexible repayment schedule

- Online application

A £500 Conduit loan over 39 weeks; total amount repayable £756.78 made up of £15 admin fee (taken from loan amount advanced); 39 repayments of £19.02 per week. Interest rate 111.03% p.a. (variable). 217.5% APR Representative. 3% variable admin fee.

Easiest payday loan to get approved for

Swift Money

- 97.5% approval rating

- Same day cash possible

- Quick, no obligation quote

Borrow £250 for 30 days. Interest: £60 - Interest rate: 292.25% per annum (fixed). Representative APR: 815.74% (variable) - Total amount payable: £310

Best payday loan for bad credit

Quid Market

- Flexible repayment terms

- New customers can borrow between £300 and £600

- Decisions are made by a human

Borrow £300 for 3 months / Interest payable £154.37 / Total amount payable: £454.37 in 3 instalments / 3 payments of £151.46 / Representative 1297.6% APR / Interest rate 292% per annum (fixed) / Maximum APR 1625.5%

Quickest payday loan

Fast Loan UK

- Can receive cash within 5 minutes of approval

- Flexible repayment options

- Apply online

Borrow: £500 over 16 weeks. 4 repayments of £183.59. Total amount payable £734.36. Interest rate: 151.4% pa (fixed). Representative 766.18.% APR.

Best payday loan for early repayment

Cash ASAP

- No fees for early repayment

- Transparent application process

- Convenient online portal

£300 loan for 21 days at a fixed interest rate of 290% pa. Total amount payable is £350.05 in one single repayment. This is based on the amount of credit plus interest, no other fees apply. Representative 1361.1% APR

How to choose the best payday loan for your situation

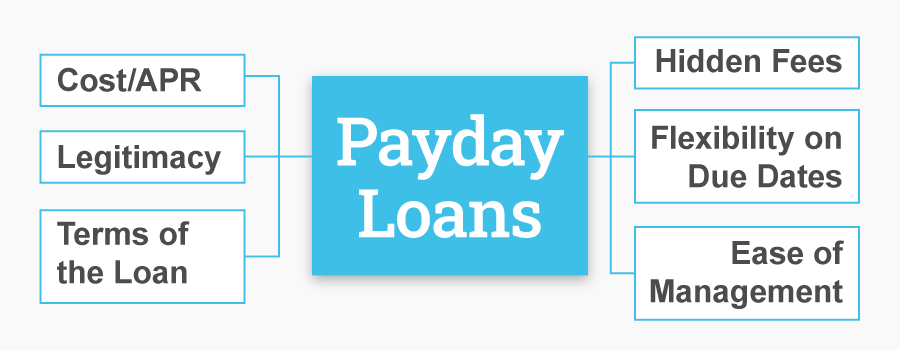

Six things to consider when choosing your payday loan

Cost/APR

Any borrowing incurs a fee, and this has been a notorious issue with payday loans since their invention. Make sure to read the fine print so you know what the APR is, any other fees, and how much you will repay in total for your loan.

Legitimacy

Not all loan providers are created equally—or legally. Make sure the provider you choose is registered and compliant with the Financial Conduct Authority. If they’re not, simply walk away.

Terms of the loan

Read all of the details and paperwork provided before you sign anything. Good terms for a payday loan will include items like low interest, so you pay less for the loan, flexibility in the date for repayment, and low penalties for late payments.

Hidden fees

Thankfully under the FCA, fees and charges on payday loans are capped. But they can still charge up to £24 for every £100 borrowed. You can also be charged up to £15 plus interest every time you default on a payment.

Flexibility on due dates

You’ll want a lender with some flexibility on due dates for repayment—this could be in the shape of no or low fees for late payment, or the possibility of setting a date that lines up with when you have been paid.

Ease of management

How easy is it to make payments, see your statement, and control the stance of your loan? For some, the easiest way is a convenient online portal while others prefer a brick-and-mortar store they can visit. Make sure you’re comfortable with whichever method the lender uses, or find a different one.

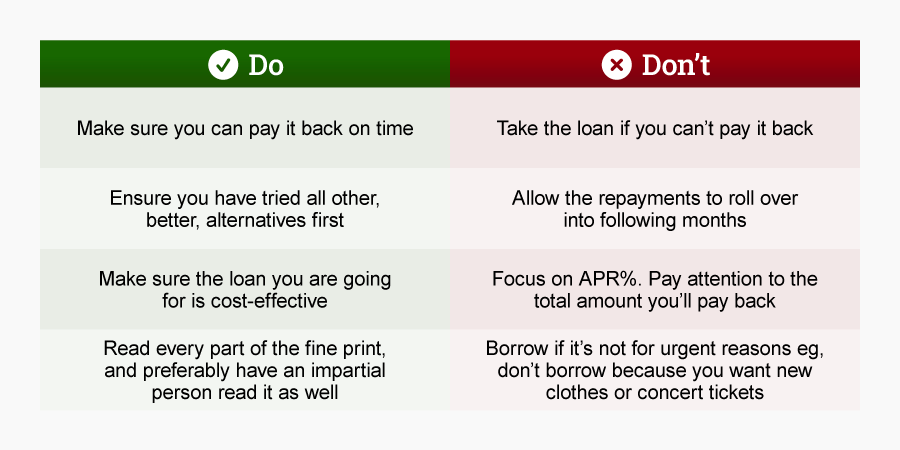

Dos and don’ts of applying for a payday loan

Payday loans should only be a last resort when all other options have been considered. If this is you, then here’s a list of dos and don’ts of applying for a payday loan.

Do

It is crucial, before even thinking of applying for a loan, to be sure you will be able to pay it back on time. Late repayments incur fees and interest and can lead to further problems. It is also important to make sure all other options have been exhausted.

Once you’ve settled on applying for a payday loan, make sure it is as cost-effective as it can be. All payday loans will be expensive, so look for the one that is least expensive without compromising on other aspects like time frames and flexibility.

Finally, make sure you read every last detail within the fine print. The last thing you need is an unexpected fee impacting your ability to repay the loan.

Don’t

Do not take the loan if you have any reason to believe you will not be able to pay it back. Failure to repay your loan on time will incur further fees and charges and ultimately can result in collection agencies knocking on your door. In that vein, don’t allow your repayments to roll over. This results in the charges increasing exponentially and makes them much harder to pay back.

When shopping for a loan, don’t just focus on the APR%. While it is important, the most important detail is the overall amount you will be paying back.

Finally, don’t borrow the money at all if it isn’t urgent. Wanting to go to a concert or buy some fashionable new clothes isn’t an urgent need and isn’t worth the risk that comes with payday loans.

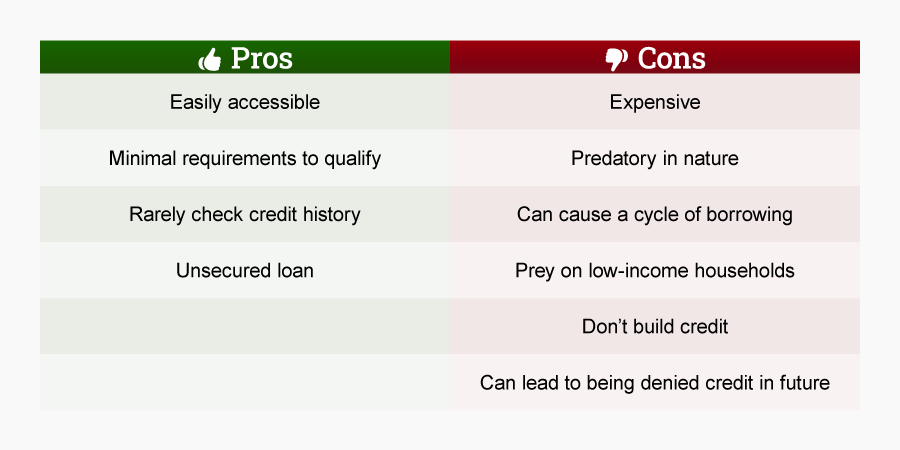

Pros and cons of payday loans

While they should always be a last resort, there are some pros to payday loans as well as cons.

Pros

Payday loans are easily accessible, whether online or in brick-and-mortar shops, which means a wide array of people can find them if needed. There are also minimal requirements needed to qualify for one.

Those with bad credit history can also benefit from this emergency cash source because payday loan providers seldom check the credit history of those they lend to. Payday loans are also unsecured loans, so you won’t have to risk any personal belongings such as a car.

Cons

However, there are considerably more downsides to a payday loan. Perhaps most importantly, they are expensive and can result in people paying back twice what they borrowed initially. Their design and intention mean they are typically geared at low-income people, who have little to no wiggle room when it comes to their budget.

Payday loans, and their fees, can lead to a cycle of borrowing where repaying the loan means someone will be short of money again in the very near future.

Payday loans also do nothing to build your credit score—in fact, if future lenders for things like car loans and mortgages see you’ve had a payday loan, they may deny you credit.

What are some alternatives to payday loans?

The best alternative to payday loans is to not borrow at all, but this is not feasible for many people. There are a few alternatives to payday loans that may better suit your situation that you may not have thought of.

Borrowing money for essentials

Borrowing from friends and family

No one enjoys borrowing from family and friends, but doing so in an emergency instead of resorting to a payday loan means not having to pay steep fees and interest rates.

Using savings

Whilst it may be painful to use the Christmas or holiday fund to pay an unexpected bill, it works out as much more cost-effective in the long run.

Get an advance

Speak to your boss about being paid earlier than usual. Most good bosses should be accommodating in an emergency. If you’re on benefits, you can ask to be paid early too, though it’s important to check with your personal advisor.

Speak to your service provider

If you find you are always struggling to pay a certain bill, speak to your provider and you should be able to move the payment date to a more convenient one.

Overdraft

While it’s also important to not rely on an overdraft, they are a much more cost-effective way to access emergency funds. Some banks offer free overdrafts, and even paid overdrafts have lower rates than payday loans.

Best payday loans FAQ

What is a payday loan?

A payday loan is typically a small amount of money that is borrowed at a high rate of interest, which is intended to be paid back once the recipient has received their next pay cheque.

When should I get a payday loan (and when should I not?)

A payday loan should always be a last resort and there are several situations where you definitely shouldn’t get one. That being said, there are scenarios where they are the only, even if not the best, option.

When to get a payday loan

A payday loan can be appropriate when you have an urgent, same day, need for cash and are very confident you will be able to pay it back, with the interest and fees, on payday. This could be for an emergency bill that has popped up that insurance won’t cover, such as a car or house issue.

When not to get a payday loan

There are many more situations where it is not appropriate to seek out a payday loan:

- To fund non-essential things. This can include going out partying, concerts, and fashion.

- To regularly help you to pay a bill.

- If you aren’t confident you will be able to pay it back in time.

- If there is an alternative option that is less expensive.

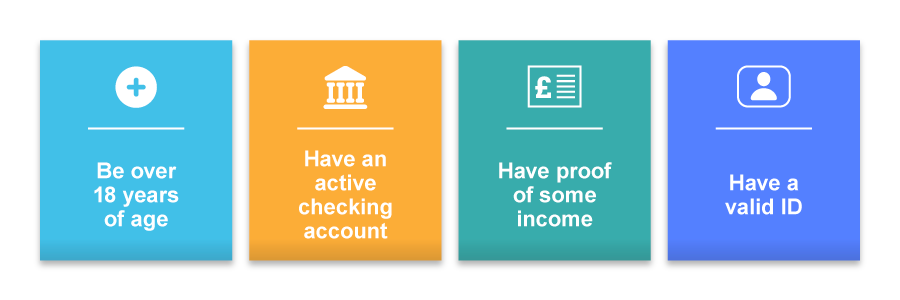

How do I get approved for a payday loan?

Payday loans are infamous for needing very little in order to get approved for one. Typical criteria for a payday loan are:

- Be over 18 years of age.

- Have an active checking account.

- Have proof of some income.

- Have a valid ID.

Most payday loan lenders don’t check credit history as part of their approval process, so even those with bad credit can be approved for one.

How many times can I apply for a payday loan?

While it isn’t recommended to have even one payday loan, it is possible to have multiple loans simultaneously. This, however, would be a terrible idea. Multiple payday loans mean it would be easier for payments to get away from you, contributing to a debt cycle, and would be detrimental to your credit score.

What happens if I fail to repay my payday loan on time?

Some lenders offer a grace period of 48 hours, and this is even more likely if you contact them and give a valid reason as to why you can’t pay on time. However, this does vary by lender and cannot be relied upon as a certainty.

Initially, if a lender hasn’t heard from you and the payment date is missed, they will try to contact you by email, phone, and text. If none of these work, they will reach out via letter.

Failing to pay will also incur a late fee, which is capped at £15 per instance of missed payment. If you fail to pay for three months, you will incur this fee for every missed monthly payment.

You will also be incurring interest, capped at 0.8%, for every day the outstanding bill is not paid.

Missed repayments will also have a negative impact on your credit score , which will worsen as time goes on.

Lenders also have the right to send the details of a borrower to a collections agency, to recover the debt owed.